1 / 10

Listing ID: HSFa73abc69

Block of apartments for sale

Paul O'Shea Homes - London, Surrey & Kent

7 days agoPrice: £1,400,000

South London - Croydon

- Residential

- Apartment

- 0 Bed(s)

- 0 Bath(s)

Features

Parking / Garage

Description

Off-Market Investment Opportunity - £1,400,000 for the Freehold Interest

We are pleased to present this well-maintained residential development consisting of two purpose-built blocks, offering a prime investment opportunity.

The front block contains 4 x 1-bedroom flats, while the rear block includes 2 x 1-bedroom flats, each with parking spaces. There is also planning permission granted to extend Flats 1 and 2 (rear block) by 1.8m, providing an opportunity for further development should the buyer wish to do so.

The current owner has enjoyed 9 years of consistent, high-yield income, with all flats under AST agreements, producing a strong rental return of £79,000 per annum, with the potential to increase this to £90,000 per annum.

Current Income and Tenancy Details:

Flat 1 – £10,500 PA – long-term tenant (market rent: £15,600)

Flat 2 – £15,600 PA – tenancy ends January 2025

Flat 3 – £11,700 PA – under-let

Flat 4 – £13,800 PA – market rent (since June 2023)

Flat 5 – £13,800 PA – under-let

Flat 6 – £13,800 PA – under-let

Estimated Market Value (per unit):

Flat 1 – £240,000

Flat 2 – £240,000

Flat 3 – £240,000

Flat 4 – £245,000

Flat 5 – £245,000

Flat 6 – £255,000

All flats have a current BLP 10 year Building Warranty:

Flats 1-2 expire on the 24th November 2024

Flats 3-6 expire on the 30th October 2025

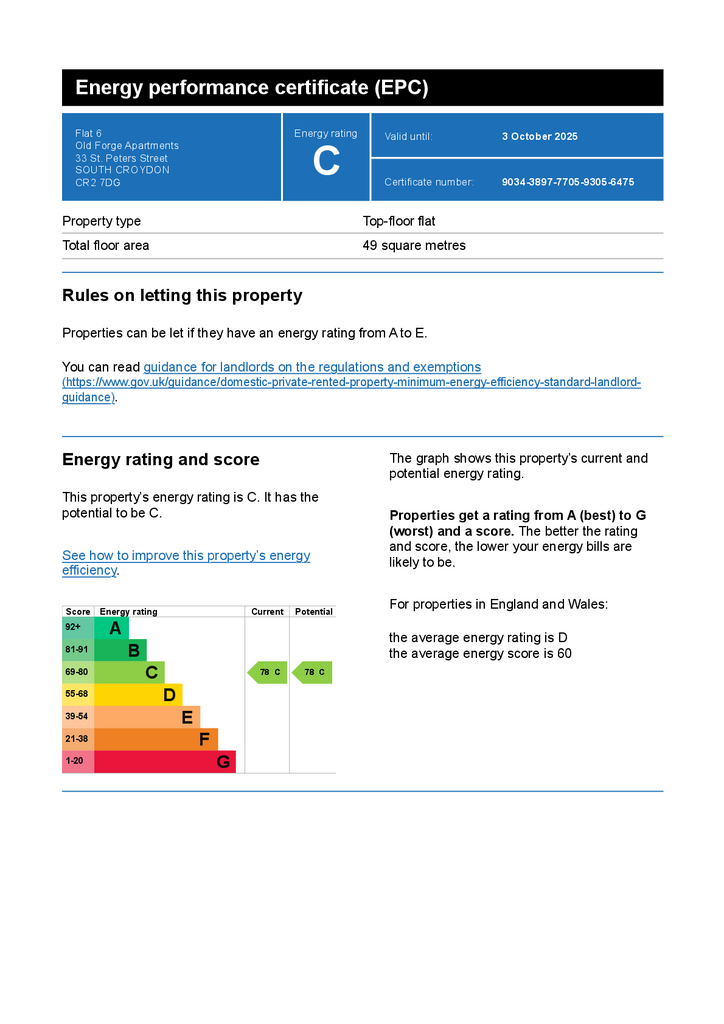

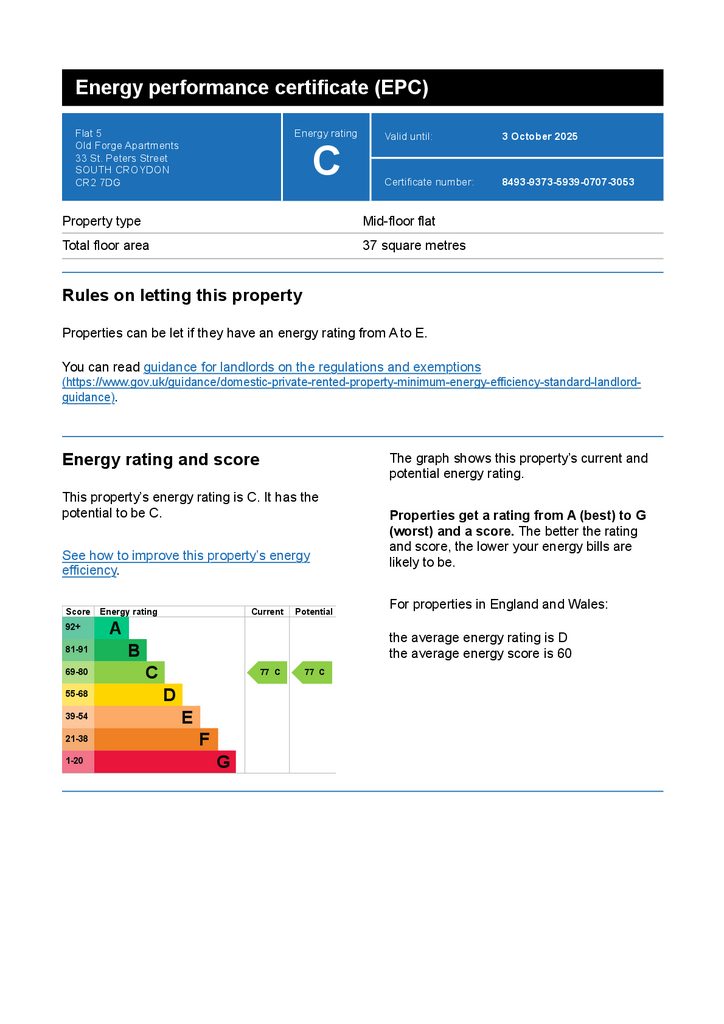

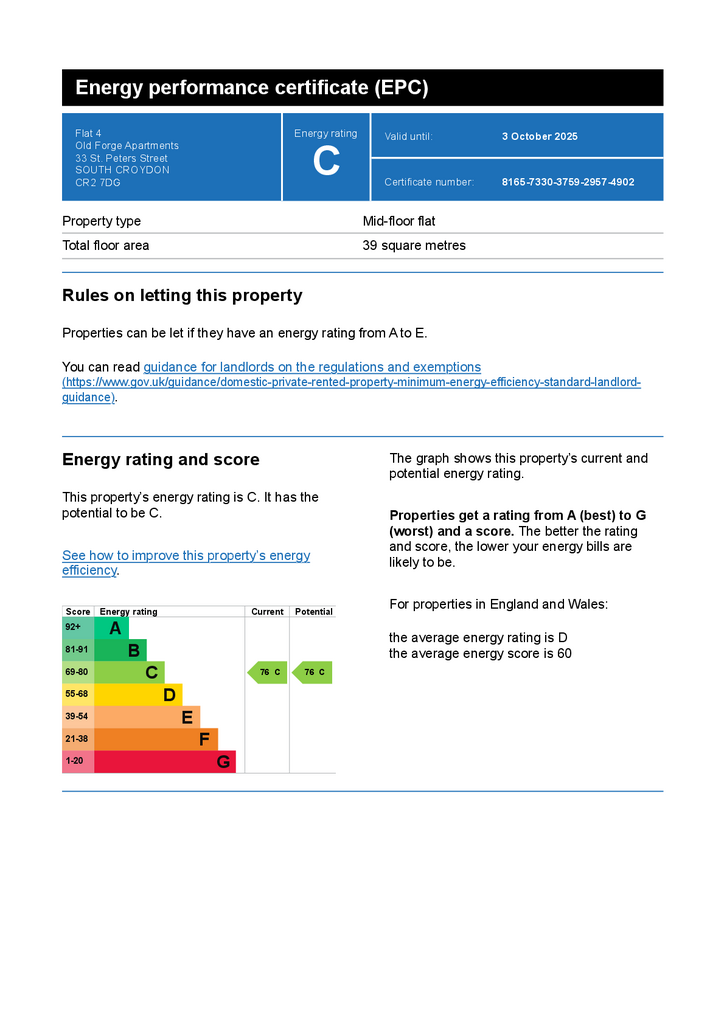

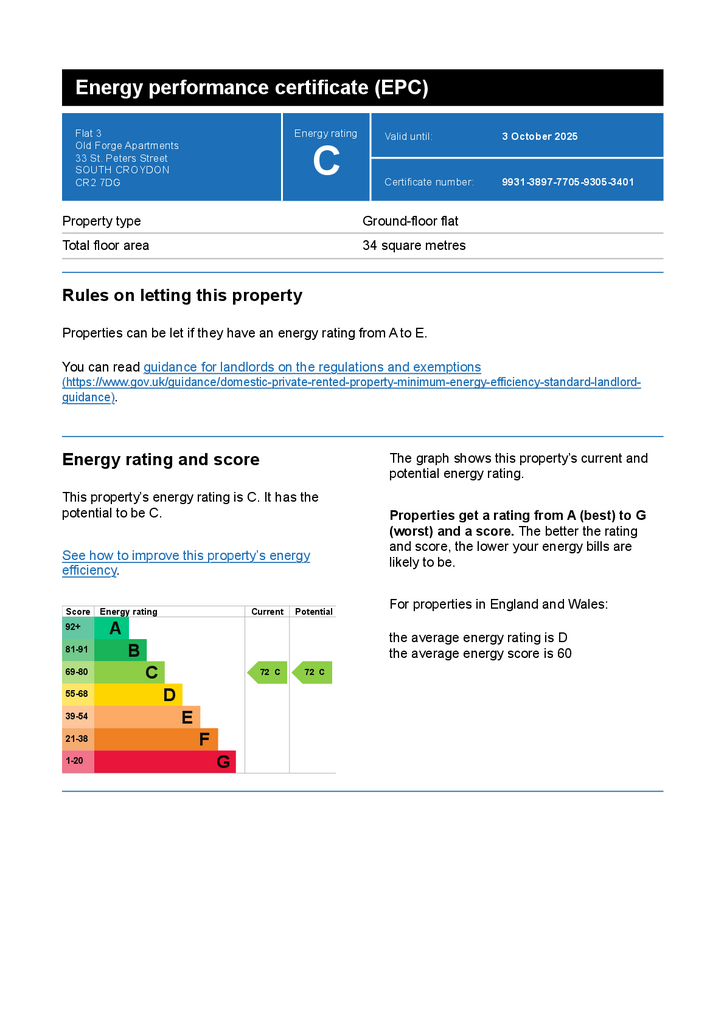

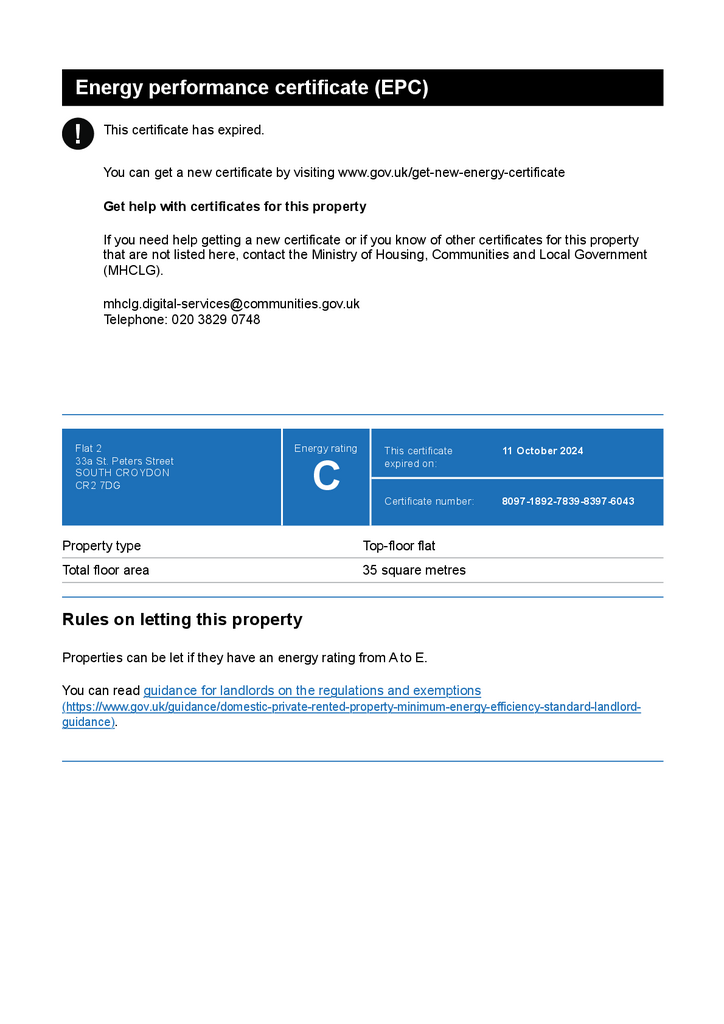

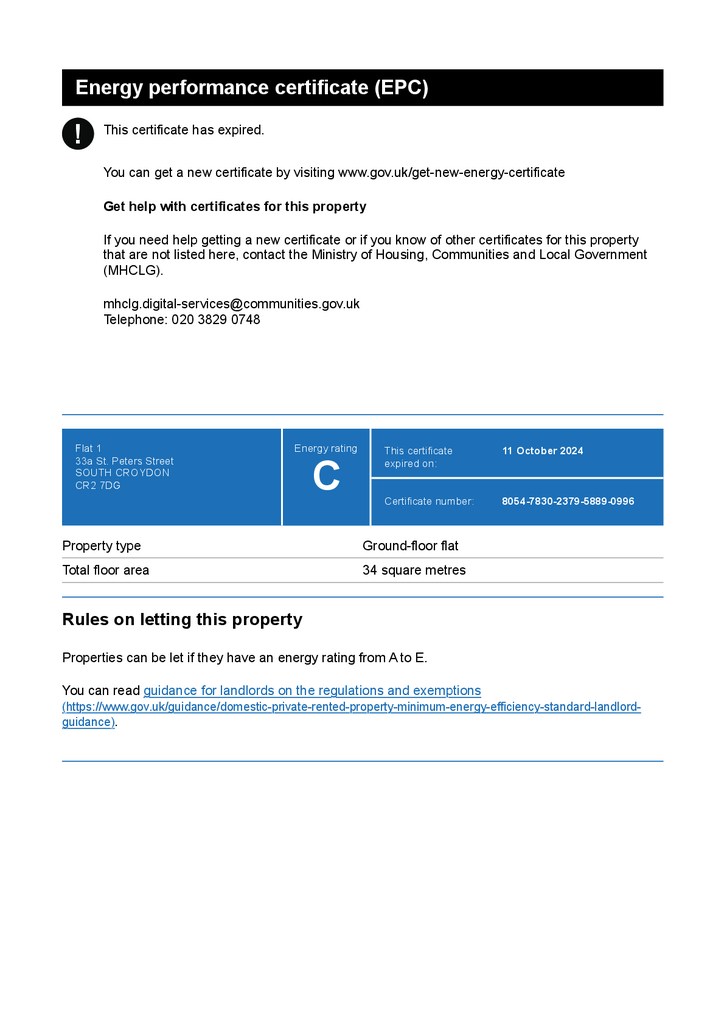

All Flats have an EPC of C

Total estimated market value: £1,465,000

Asking price for the entire freehold: £1,400,000

This development presents a unique opportunity for investors seeking a reliable income stream with potential for rental growth and long-term capital appreciation. Contact us for more details on this off-market transaction.

We are pleased to present this well-maintained residential development consisting of two purpose-built blocks, offering a prime investment opportunity.

The front block contains 4 x 1-bedroom flats, while the rear block includes 2 x 1-bedroom flats, each with parking spaces. There is also planning permission granted to extend Flats 1 and 2 (rear block) by 1.8m, providing an opportunity for further development should the buyer wish to do so.

The current owner has enjoyed 9 years of consistent, high-yield income, with all flats under AST agreements, producing a strong rental return of £79,000 per annum, with the potential to increase this to £90,000 per annum.

Current Income and Tenancy Details:

Flat 1 – £10,500 PA – long-term tenant (market rent: £15,600)

Flat 2 – £15,600 PA – tenancy ends January 2025

Flat 3 – £11,700 PA – under-let

Flat 4 – £13,800 PA – market rent (since June 2023)

Flat 5 – £13,800 PA – under-let

Flat 6 – £13,800 PA – under-let

Estimated Market Value (per unit):

Flat 1 – £240,000

Flat 2 – £240,000

Flat 3 – £240,000

Flat 4 – £245,000

Flat 5 – £245,000

Flat 6 – £255,000

All flats have a current BLP 10 year Building Warranty:

Flats 1-2 expire on the 24th November 2024

Flats 3-6 expire on the 30th October 2025

All Flats have an EPC of C

Total estimated market value: £1,465,000

Asking price for the entire freehold: £1,400,000

This development presents a unique opportunity for investors seeking a reliable income stream with potential for rental growth and long-term capital appreciation. Contact us for more details on this off-market transaction.

See Also

Loading...

Loading...

Loading...

Loading...